Fintech Trends we’re keeping an eye on for 2023

Our current three largest markets that we’re building brands and driving demand into are Enterprise technology, Saas and Finance and Fintech is the where those three converge. It’s also the most disruptive, so can be the fun but also volatile. The whole space took a large hit in 2022 with liquidity issues and failures, and will this year be any better? So here is what are we keeping an eye on for 2023.

(1) Is the Crypto Winter Over? and is it entering an Ice Age?

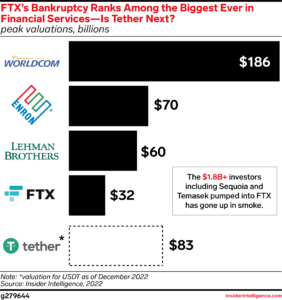

Clearly the big Crypto firms are not too big to fail. Crypto’s biggest scandal to date is the FTX bankruptcy, that creates contagion. For example, FTX’s $400 million credit facility led to BlockFi’s collapse, which is tied in a crypto-leveraged knot. In spite of this, the busts will have a minimal impact on the broader financial system, as regulators have shielded mainstream providers from crypto-assets. It is important to note that the FTX failure was more down to miss-management or intentional fraud, than the failure of the technology but the bear market did expose what they were up too – and if the price of their own token, FTT, would have stayed high – they probably would have got away with using client deposits for trading and liquidity for a much longer time.

The following are some of the ways in which 2022 fallout will freeze crypto in 2023:

-

There will be a drying up of institutional capital. Cryptos’ poor performance and heightened uncertainty will deter investors from investing in them in 2023. Most of the US government- and state-sponsored pension funds that are currently investing in cryptos will be included in this group.

-

Crypto firms could be further hindered by regulation. Regulation will focus heavily on protecting consumers, such as mandating proof of reserves for stablecoins.

-

There will be a decline in VC funding for crypto firms. As a result of FTX and BlockFi burning big names like Sequoia and Tiger Global, fewer deals will be closed.

-

There could be a loss of appetite among retail investors. After millions lost money in 2022, they’ll find other uses for their money than speculating on crypto. But the market is cyclical, and Bitcoin has now recovered back over $20k, so we shouldn’t underestimate the retail degens appetite for an x100 potential. Whens the next halving?

So, some things to consider:

-

Who’s next? Genesis is fighting insolvency (trying to make a deal as I type) and Coinbase bonds are trading at distressed values. Alongside this lots of players are announcing layoffs, including Kraken, who shed 30% of its staff. That said, Binance is looking forward and recruiting and continuing to innovate in the space. They are just rolling out Mastercard Send, which allows users real-time payment from your Binance account to any Mastercard card globally.

-

Keep an eye on Stablecoins. Lot’s of the regulation will focus on stablecoins, and those that survive will have to be backed by deposits that are FDIC insured and held at banks. Tether always has some FUD, so we could see a run on USDT if its reserves are found to be overstated. That said, regulation brings in investment, and a global standard for banks’ exposure to crypto assets has been endorsed by the Group of Central Bank Governors and Heads of Supervision (GHOS) of the Bank for International Settlements (BIS). The standard, which sets a limit of 2% on crypto reserves among banks, must be implemented on Jan. 1, 2025.

- DEFI going mainstream. With BlackRock and BNY Mellon hailing tokenization as the next big thing in finance and JPMorgan having recently executed its first trade on a public blockchain. It’s clear Defi is here to stay! Pick your L1 bias.

(2) Is the Financial Wellness the new marketing/services hook?

Insurance customers will be won with financial health offerings in 2023. Financial health is at the top of consumers’ minds as a result of the cost-of-living crisis and market volatility of 2022. As the downturn dampens demand for life insurance, insurers are looking for a new hook.

It’s a no-brainer for insurers to invest in financial wellness-here’s why:

-

It’s what customers want. In a June 2022 Capgemini survey, insurers ranked second only to banks as consumers’ preferred financial wellness partners.

-

It will benefit insurers’ bottom lines. Insurers’ payouts on insurance claims are reduced when their financial health improves. It has been shown that financial well-being can alleviate anxiety and stress, for example.

-

Customers are willing to provide insurers with the data they need to provide incentive-based financial wellness tools. Consumers have increasingly shared driving and health data in exchange for savings and rewards in recent years.

So, some things to consider:

Insurance companies will focus on rare offerings that can move the acquisition needle. Basic money management features and financial education will no longer suffice.

-

More well-being tools will be personalized. A good example of this would be rewarding customers for healthy financial behaviors or incorporating them into policy pricing.

-

Their offerings will be expanded through new partnerships. Personalized budgeting tools and value-add products and services will be embedded in insurers’ platforms by partnerships.

(3) Do or Die for challenger banks?

Also known as Neobanks, most of the world’s 291 challenger banks not being able to turn a profit, so will investors lose patience. 2023 is likely to see investment shift from growth potential to profit potential, so what does this mean?

Taking a look at how it will affect neobanks:

-

Neobanks that are not profitable will not survive. Besides businesses and shareholders, this will also affect the larger network of banking as a service (BaaS) partners that power neobanks. FTX, which is now defunct, was a bank partner of Evolve Bank & Trust, which came under scrutiny over financial exposure.

-

There will be new revenue streams emerging. BaaS, credit cards, and lending products could help providers achieve the holy grail of profitability. Revolut, Starling, and Nubank have all made impressive progress in their respective fields.

-

There will be a tightening of risk management controls. Neobanks will revamp their underwriting policies after years of growth at all costs. In order to drive higher balances, they’ll focus on attracting more profitable customers.

So, some things to consider:

-

The Strong with thrive. Nubank is profitable, Dave (not my mate, the neobank) is looking strong and expecting to be in profit by 2025, so who else will join is small band?

- The market will consolidate. Today there are 291. Odds on there will be a lot less by the end of 2023, whether thats from mergers, acquisitions or bankruptcies.

(4) Growing pains for embedded finance

So embedded finance is non-financial companies offering financial products and services. It could be an e-commerce merchant providing insurance, a coffee shop app that offers 1-click payments, or a department store’s branded credit card. The rapid growth of embedded finance has inflated expectations. With this “as a service” partnership model, platform providers and sponsor banks enable brands as small as yoga studios to offer financial services to their customers. However, as space crowds and economic conditions deteriorate, not all tie-ups will succeed.

What happens when expectation meets reality.

-

There will be a lot of ups and downs this year. Although the embedded finance industry benefits from more lucrative margins on lending and credit appetite during challenging economic times, rising loan defaults and falling swipe fee revenues are expected to hurt the industry.

-

As risky partnerships sting providers, regulators will circle. As unprofitable partnerships end in 2023, platforms will consolidate. Some worst-case scenarios, such as bankruptcies, may leave consumers without access to their funds, causing harsher regulations.

-

In the long run, revenues will increase. According to a September 2022 report by Bain & Company, brands and BaaS platforms will earn more than $51 billion from embedded finance between 2021 and 2026. Until 2026, payments will remain dominant-think of Uber’s checkout flow-but other categories will eat into its market share.

So, some things to consider:

- For those that want to enter the space – for sure the low-code and no-code solutions will be a big success in 2023 as companies seek to enter the embedded finance.

- For those already in the space the big guys will focus on building out full-stack embedded finance.

At Creation we’re looking forward to ’23. We have started the year with some large new projects with existing clients and even some new customers, including our first campaign with Binance (largest Crypto exchange). As we focus on generating pipeline that converts, a shift towards considered and sensible marketing for business growth really suits us.